beeziCarte

Gérez vos cartes et proposez-les à vos clients via un QR-Code.

Simplement et rapidement.

Essai gratuit sans engagement pendant 10 jours !

En quelques clics :

- Cliquez sur le bouton « J’essaye » ci-dessus

- Créez un nouveau compte et complétez le formulaire d’inscription

- Ajoutez des pages à votre carte en téléchargeant des photos prises avec votre smartphone

- Votre QR-Code est disponible immédiatement

Vous pouvez alors imprimer le QR-Code sur les supports de votre choix et inviter vos clients à le scanner sur leur propre smartphone pour accéder à votre carte.

NOUVEAU: beeziCarte gère votre cahier de rappel COVID-19.

On en parle aussi ici

Soutenu par la CCI Alsace

Newsletter juillet/août 2020

Dans la presse

DNA

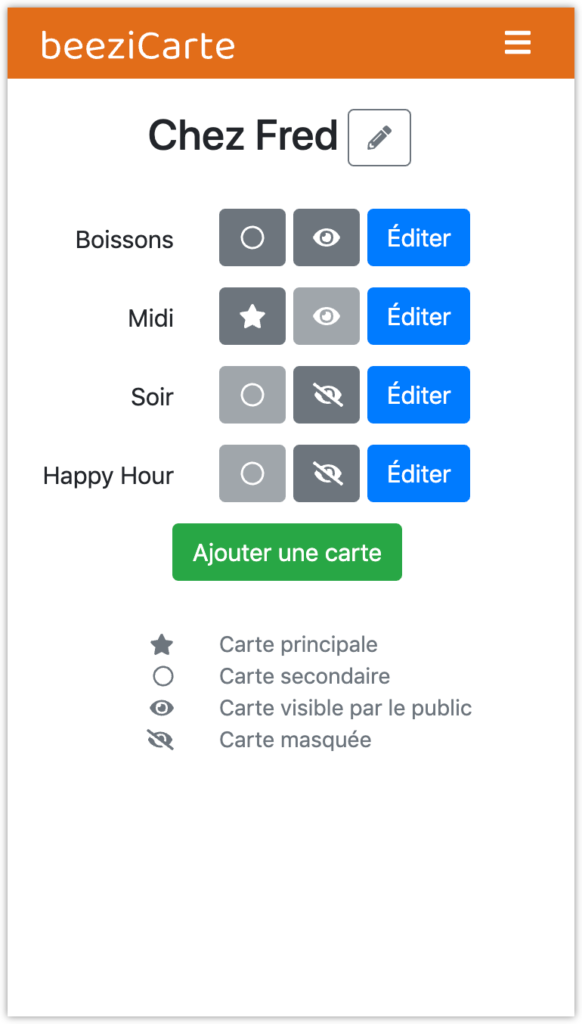

Gérez vos cartes

- gérez plusieurs cartes

- choisissez/changez votre carte principale en 1 clic

(celle pointée directement par le QR-code) - masquez ou publiez vos cartes en 1 clic

(selon service midi/soir, promotions spéciales, …)

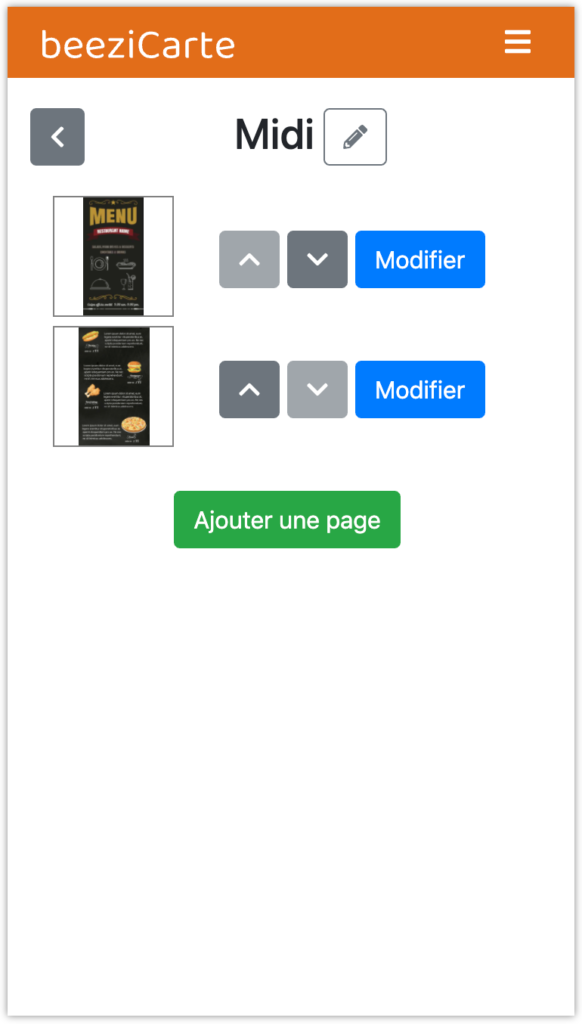

Éditez chacune de vos cartes

- ajoutez plusieurs pages à vos cartes

- prenez une photo des pages de vos cartes physiques actuelles

- ou bien chargez un fichier image depuis votre smartphone ou depuis votre ordinateur

- changez facilement l’ordre des pages

- remplacez ou supprimez les pages créées

Votre QR-Code est prêt immédiatement

- votre QR-Code pointe vers votre carte principale

- exportez-le pour l’imprimer sur les supports de votre choix

- vos clients peuvent naviguer parmi les autres cartes publiées

Configurez chacune de vos cartes

Vous pouvez :

- nommer librement vos cartes

- ajuster les conditions de visibilité de chaque carte selon vos services

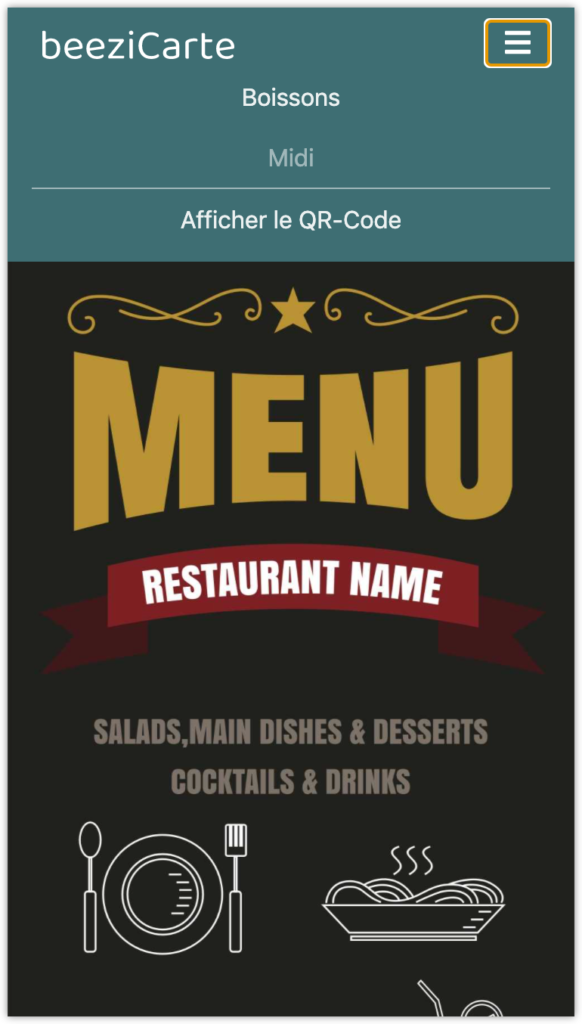

Vos clients accèdent à vos cartes

Vos clients peuvent :

- scanner le QR-Code et accéder directement à votre carte principale

- naviguer parmi vos autres cartes publiées à l’aide du menu

- zoomer sur les pages pour plus de confort

- afficher le QR-Code pour le transmettre de proche en proche

Avantages

- démarrage en quelques clics, aucune app à installer

- votre QR-Code est disponible immédiatement

- conforme au protocole sanitaire HCR arrêté par le Ministère du travail (Covid-19)

- votre carte est en ligne en quelques minutes : photographiez chaque page de votre carte physique actuelle et c’est réglé !

- mettez spontanément en avant des offres promotionnelles et retirez-les aussi simplement

- fin des coûts de réalisation des cartes physiques (papier, impression, supports)

- réduction de l’impact écologique grâce à la dématérialisation

- accessible depuis votre ordinateur pour télécharger des images de meilleure qualité

- vous conservez la maîtrise complète de l’identité visuelle de vos cartes

Tarif

Abonnement trimestriel de 60 € (tous les 3 mois).

Réduction de 10 € sur votre première échéance à la commande.

Une question ?

contact@beezicarte.fr

Frédéric Klein

06 67 97 11 74

67600 Kintzheim Alsace

Alsace